property tax calculator frisco tx

The tax is based on the 100. FOR SALE - See 25 photos - 3267 Oyster Bay Dr Frisco TX 75036 2 bed 2 bath 1454 sqft house 424900 MLS 422192530.

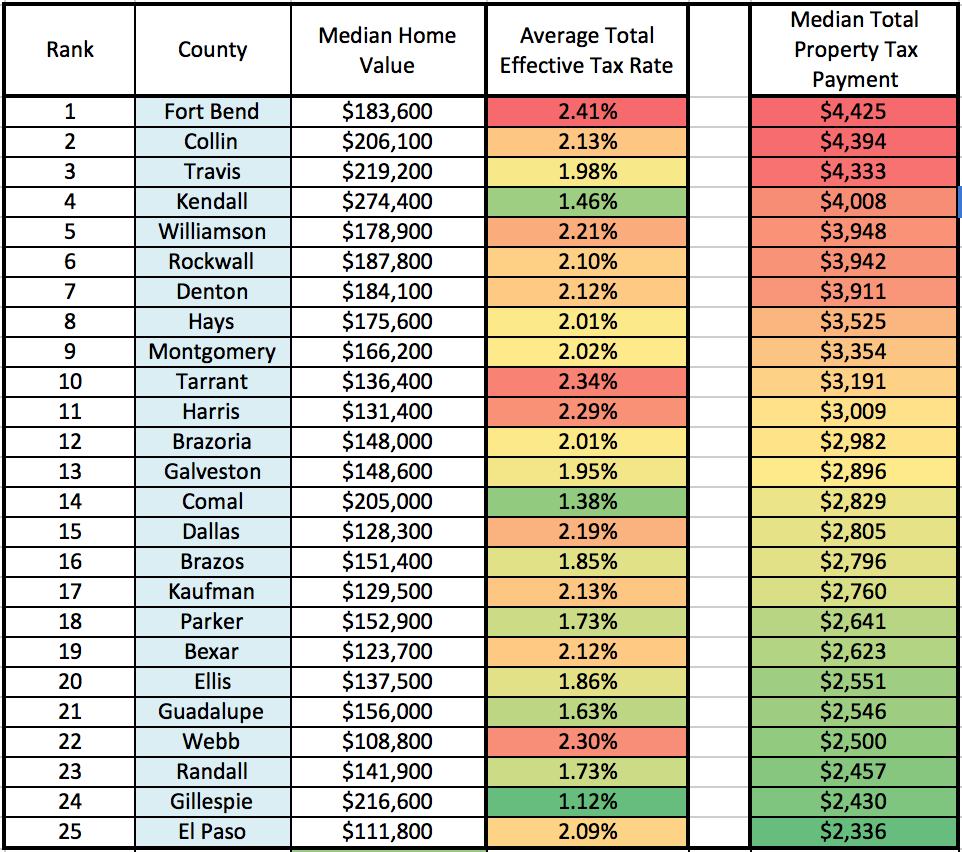

Texas Has Some Of The Highest Property Taxes In The Nation

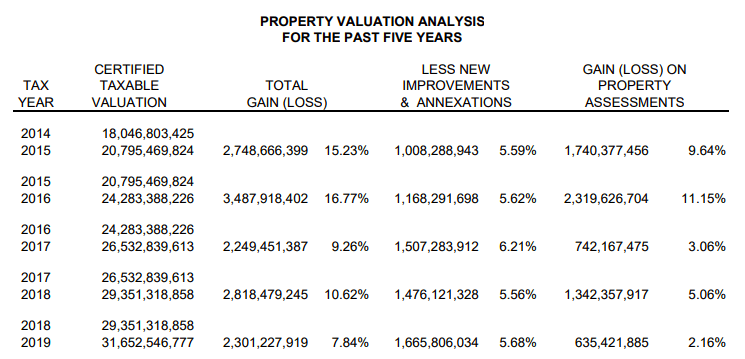

County taxes are levied in addition to community college.

. Frisco texas and little elm texas change places. Enter your Over 65 freeze year. The formula for calculating your annual tax bill is tax rate.

In our calculator we take your home value and multiply that by your countys effective property tax rate. Learn about Frisco Texas property taxes from Frisco Top Realtor and Frisco Luxury Home Realtor Real Estate Agent - What is my Frisco home worth. Purefoy Municipal Center Frisco City Hall 6101 Frisco Square Blvd Suite 2000 Frisco TX 75034 Map.

Our Texas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property. The Lone Star State has a property tax rate of 183 which is. Property taxes Since these entities have different tax rates Celina real estate property tax rates for 2017 range from 256 percent to 259 percent of tax appraisal value.

These entities are legal governmental districts run by officials either appointed or voted in. Texas Property Tax System. Skip to content 1 210 776 1833.

There are three basic phases in taxing real estate ie formulating mill rates estimating property market worth and receiving receipts. Taxpayer Rights Remedies. Learn about Frisco Texas property taxes from Frisco Top Realtor and Frisco Luxury Home Realtor Real Estate Agent - What is my Frisco home worth.

469-362-5800 Hours Monday through Friday 8 am. The tax rate is a published amount per 100 as a percentage that is used to calculate taxes on property. This is equal to the median property tax paid as a percentage of the median home value in your county.

Outstanding floor plan with the designers Industrial Farmhouse interior scheme. Collin County Tax Assessor-Collector Frisco Office. Our Texas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average.

When added together the property tax. Property Tax General Information PDF Resources Forms. The current market value of real estate is used to calculate property taxes also known as ad valorem taxes.

The formula for calculating. Enter your Over 65 freeze amount. Calculate your property tax with our online property tax calculator.

Check out this gorgeous lifestyle home located in one. Our Texas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar. Local property taxes are based on the value of taxable property called ad valorem which means according to value in Latin.

On a 400000 home a difference of 050. Furthermore some areas include special assessments for community colleges or for fresh water districts or other utility districts. Paladin Tax Consultants helps you in Appeal and Protest against unfair property tax assessment and increase.

Frisco as well as every other in-county public taxing unit can at this point compute required tax rates since market value totals have been recorded. Taxing entities include Frisco county governments and various special districts such as public colleges. Collin County Tax Assessor Collector Office 6101 Frisco Square Boulevard 2nd Floor Frisco TX 75034 Phone.

CB JENI HOMES CAMELLIA floor plan. Texas property tax rates are among the highest in the United States.

Property Tax Calculator Property Tax Guide Rethority

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Dallas Dfw Property Tax Rates H David Ballinger

How Property Taxes Are Calculated

Plano To Approve Two Cent Tax Rate Reduction Proposal

Frisco Maintains Tax Rate Adds Staff For Fiscal Year 2023

Frisco Recommends Raising Property Taxes Texas Scorecard

Frisco Officials Look For Compromise On Tax Caps Community Impact

Property Tax Reform Is Something We Mayor Jeff Cheney Facebook

Dallas Unveils 4 51 Billion Proposed Budget And Reduced Property Tax Rate Candysdirt Com

Texas Homeowners Reeling After Property Tax Appraisals Skyrocket Cbs Dfw

.jpg)

North Texas Homeowners Can Blame Higher Tax Bills On Region S Prosperity

Frisco City Council Approves Homestead Exemption Increase Property Tax Freeze For Elderly And Disabled Residents Community Impact

Texas Property Tax Calculator Smartasset

Frisco Officials Look For Compromise On Tax Caps Community Impact

What Happens When Texans Protest Their Mind Boggling Property Taxes Texas Monthly

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes